Income Tax Relief for Malaysia Car Purchase

Of course you shouldnt purchase them just for the sake of the tax relief especially if you dont need it. Inland Revenue Board of Malaysia IRBM Smart decisions.

Episode 425 An Fbi Hostage Negotiator Buys A Car Car Buying Car Loans Most Popular Cars

In other words you can purchase a personal computer smartphone or tablet in 2020 2021 and 2022 and be able to claim up to RM2500 under the special lifestyle tax relief in each year of assessment.

. On top of that individuals can also enjoy a personal income tax relief of up to RM2500 for the cost of purchase and installation rental and hire purchase as well as a monthly subscription for EV charging facilities. A tax relief limited to RM6000 is available for purchases of special support equipment for yourself your spouse children or parents who are disabled. The government had previously given a sales tax exemption for the purchase of new vehicles for the period of June 15 to December 31 2020.

Directors fees income received as a non-Malaysian citizen director of a Labuan entity are exempted from income tax until YA 2025. The total relief amount was raised by RM2000 from YA 2020s RM6000 in this category. You are only allowed to claim the money once every two years.

This relief is applicable for Year Assessment 2013 and 2015 only. Additional tax relief for the ex-husband who pays for alimony to ex-wife. Life insurance RM 3000.

To provide relief for the private sector employees who contribute to the nations social security protection scheme the government has effectively increased the SOCSO tax relief limit. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020. Income tax relief of RM2500 is given on the cost of purchase and installation rental and hire purchase of facilities as well as payment of subscription fees for EV charging.

If your chargeable income after tax relief and deductions do not exceed RM35000 and you have been allowed the tax relief of RM4000 for your spouse you are entitled to this rebate. All about income tax reliefs. Tax Relief for Individual Spouse.

Earlier this year it was reported that Malaysias new electric vehicle EV policy would offer a handsome level of tax incentives including fixed incentives that will. 21 Government grant or subsidy. Yup a maximum relief of RM4000 can be claimed by a husband who pays for alimony to his ex-wife.

Up to RM2500 for yourself your spouse and your child. Equipment for disabled self spouse child or parent. For spouse without income.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. Tuesday 29 Dec 2020 859 PM MYT. Tax rebate for self If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

In another matter Tengku Zafrul also announced government will no longer impose the Real Property Gains Tax RPGT for disposals by individual citizens permanent residents and companies from the sixth. Alimony to former wife Agreement needed iii Insurance. Increment and Reduction in income tax Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under.

A recent addition for the year of assessment 2021 where you can make another claim of up to RM2500 for the purchase of laptops personal computers smartphones and tablets. 20 Non-Malaysian directors fees income from a Labuan entity. Grant or subsidy received from the Federal or State Government are exempted from income tax.

This infographic will give you an overview of all the tax deductions and reliefs that you can claim for YA2021. To reiterate the RM4000 tax relief for spouse is provided if your spouse has no source of income or elects for joint assessment in your name. The sales tax exemption has resulted in reduced prices for passenger cars although pick-up trucks are not eligible as they are classified as commercial vehicles.

Tax rebate for self If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. With the full tax exemption the price of EVs which are mostly fully imported CBU units will be significantly cheaper. Special individual income tax relief for domestic tourism expenditure up to RM1000 is extended until the Year Of Assessment 2022.

If that isnt enough EVs will also benefit from a road tax exemption of up to 100 under the proposal while an income tax relief of up to RM2500 will be provided on the cost of purchasing and. If you are a regular SOCSO contributor you can now claim personal income tax relief of RM350. Now car price rm100k with sales tax soon car price rm100k markup price 10 without sales tax.

Education fee for tertiary level or postgraduate level. KUALA LUMPUR Dec 29 The Ministry of Finance MOF has announced the extension of the vehicle sales tax exemption period by a further six months until June 30 2021. I Education RM 7000.

Previously this personal tax relief limit was capped at RM250. This benefit has been extended to the 31st of December 2022. Ii Spouse Alimony RM 4000.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. So if you claim the amount in 2021 the next claim can only be made in 2023.

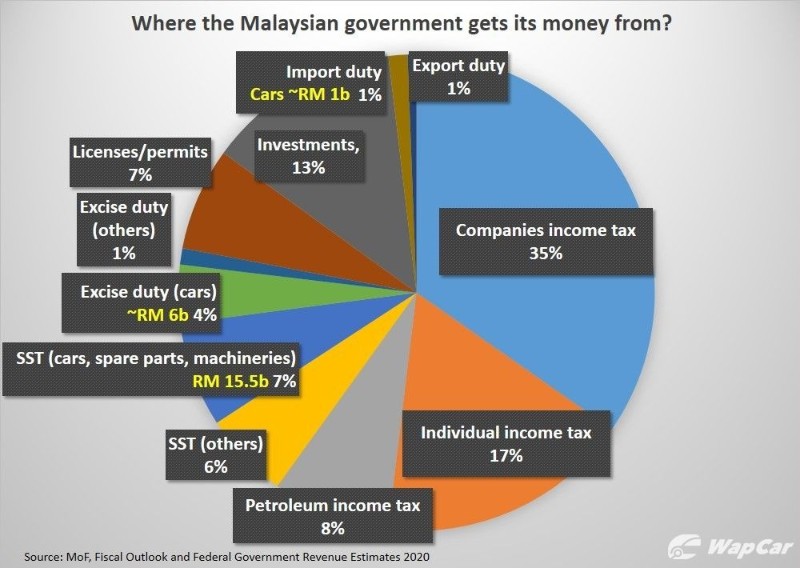

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Car Tax Calculator Calculate Your Car Taxes Car Insurance Cheap Car Insurance Inexpensive Car Insurance

Insurance Buying Tips Buy Nursing Home Insurance Insurance Buying Tips When To Buy Affordable Health Insurance Plans Buy Health Insurance Life Insurance Policy

Toyota Runs Out Of Us Tax Credits For Electric Cars Joining Tesla And Gm Bloomberg

0 Response to "Income Tax Relief for Malaysia Car Purchase"

Post a Comment